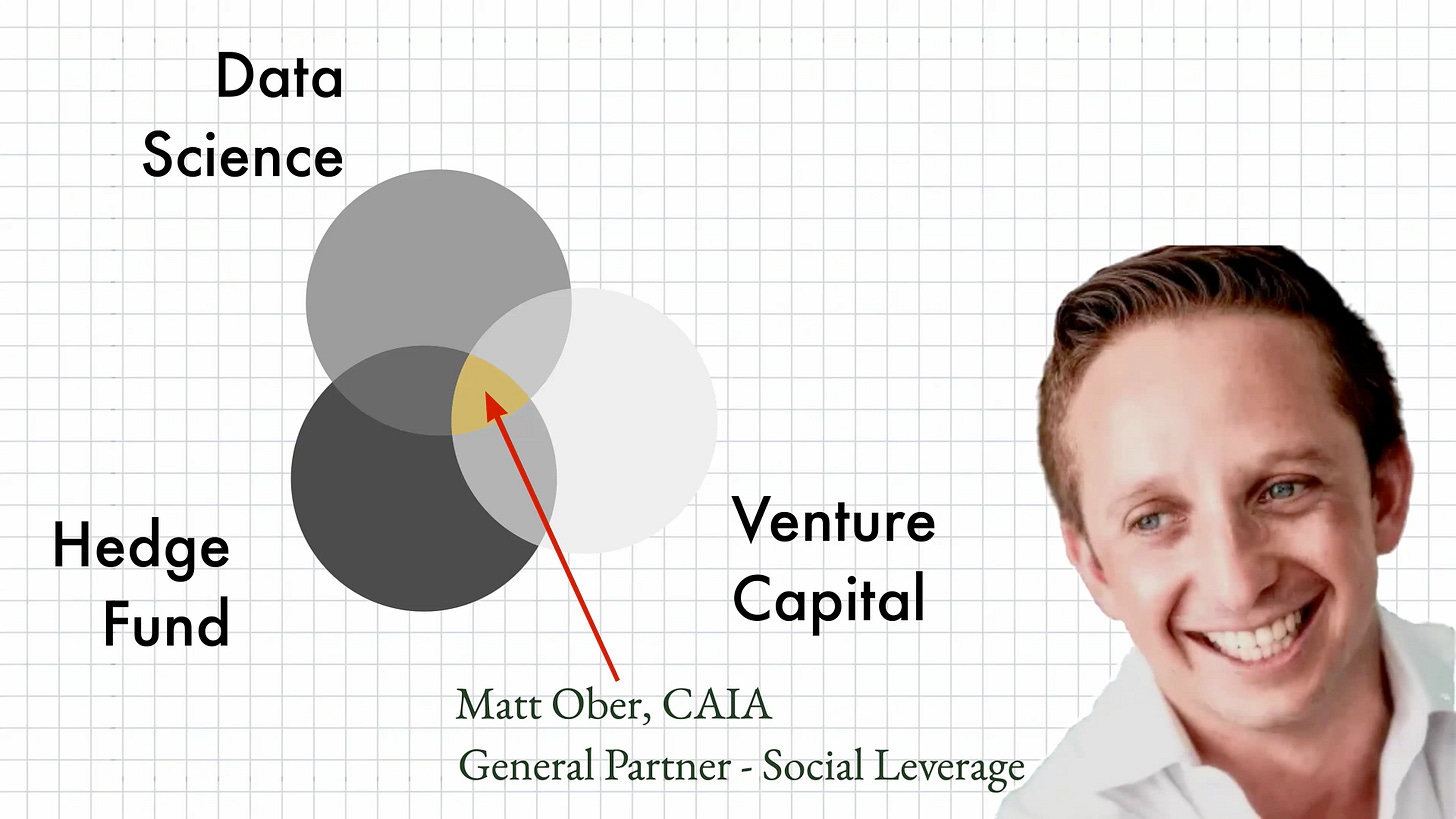

🎧 A Data Journey | Matt Ober - Social Leverage (ex-Bloomberg, ex-HF, now VC)

A deep dive in the business of financial market data, with someone who's seen (and seeing) it from every angle and is now investing in data businesses

Hi this is George. As an ex-financial markets pro, I love (re)thinking about investment management, and of course, I’ve got a podcast for that, Investology. You may also know me from the Investorama YouTube channel, where I separate investment facts from financial fiction, with clips from movies and series. My day job is to produce podcasts for smart B2B brands.

We just passed 1000 Subs on both Substack & YouTube: Thank you for being here and please keep sharing!

This post is based on my Investology conversation with Matt Ober, ex-data scientist at Bloomberg, Worldquant (a leading hedge fund) and now a venture capitalist at Social Leverage. Listen to the episode on every podcast platform, or YouTube.

First a confession: Although I’ve been involved in financial markets for over 20 years, I never truly understood the business of financial data. I thought it was a commodity, it was flowing from the terminals like water is flowing from the tap. It’s a lot more complicated and interesting than that. And I couldn’t dream of a better guest than Matt Ober to deepen my understanding.

A few highlights from our conversation:

Rethinking the investment process with data at WorldQuant and Third Point

After Bloomberg, I joined WorldQuant. Funny enough, I found the job through a Craigslist posting, which is not how most people find their hedge fund jobs. We had a thesis that if we could consume more data than anybody else in the world, we could manage more money.

Over the six years that I was there, I became head of data strategy. We went from 60 people to 600, opened up offices in 25 countries.

We spent hundreds of millions of dollars a year buying data, and we put that through our systematic trading processes. so everything from social media and sentiment to fundamentals to satellites, whatever it was, we used everything—equities, FX, commodities

Then Matt joined Dan Loeb’s Third Point as Chief Data Scientist and kept pushing the usage of data:

It was a really exciting time to think about how to push forward investors. I think that was the time when quant investing was happening. For us, it was really about data can be used for everything. Traditional investors were using their standard fundamentals management meetings, expert networks. We helped rethink the process of how we made our investment decision-making.

The state of the data value chain today

Inspired by a post from the

, which I highly recommend.As an end consumer, it's easier to consume derived data and data that's been made into something more simplified. Raw data is sometimes a lot to handle. There needs to be a lot of tagging, cleaningand organizing, and maybe combining the data and joining it with other datasets, whereas derived data might simplify things, aggregate things, make it more consumable.

The most sophisticated want the raw data, they wanna be as close to the truth as possible, that’s where there's potential alpha. You wanna get into how the sausage is made.

What’s alternative data?

I get past this whole world of quote unquote alternative data. I think it's just data, right?

Data on automobiles, is that alternative to the automobile sector? No.

Hedge funds are using Carfax data that S&P has. Maybe it's alternative, but not really, because at the end of the day, it's just a data set that people in the auto space think is extremely valuable. I think it's only expanding. I think the volume of data in the world that we live in is. Growing tremendously. I think the value of it or the price that we'll pay for it will go down over time.

We covered a lot more in the conversation, and it’s a new style of video edit, more animated, as we’re moving from a ‘podcast’ to a ‘YouTube video that you can also listen to’.

Listen to the episode on every podcast platform, or watch it on YouTube.

More information:

Matt on Linkedin: https://www.linkedin.com/in/obermattj/

Matt's Newsletter: https://www.mattober.co/

Social Leverage: https://www.socialleverage.com/

Initial Data Offering: https://initialdataoffering.com/

Related episodes:

AI hype & Reality in investment management: Dr Richard Saldanha

Jim Simons, Renaissance Technologies & The Quant Revolution | Greg Zuckerman

My Investing & Investment Management channels

Investorama - Separating Investment Facts from Financial Fiction (YouTube)

Investology - Re-Think Investment Management (YouTube)

For B2B Brands, Marketers & Podcasters

Orama (my business): helps brands grow with podcasts & videos; DM if you want to discuss a brand podcast or YouTube channel

Newsletter about B2B marketing and podcasting: on Substack