Every company Can be a FinTech

A conversation about the hype and reality of a technology that could be as transformative as the internet or mobile phones: Embedded Finance

Hi! It’s George from Investorama - Separating investment facts from financial fiction. Last week, I announced a new direction and the rebirth of my “Fintech Files” podcast. Here is the first episode: an enlightening conversation about a technology that did not take over by 2025, but is now reaching a tipping point .

Listen to the podcast. Watch the video. Read an illustrated transcript below.

Some abstract concepts can get quite personal. For my personal fintech exploration, there was a pivotal moment when I listened to A16Z’s Angela Strange talk about how every company will be a FinTech company. It was the birth of “Embedded Finance” and it inspired me. I went on to interview a couple of companies in that space, including one that is central to Angela's presentation: Synapse. Soon, I was imagining how financial services could fit with every company, including my humble video and podcast studio.

And now is a good time to revisit it, as it’s been five years, the horizon of Angela’s prediction:

Based on the attendee list, about 10% of you work in financial services. I believe that if no one in this room changes jobs, Five years from now, that number will be closer to 80%

But it didn’t happen. The spectacular collapse of Synapse happened instead. And it's not just a startup failure; it's potentially a much darker story as $160m of customer funds have disappeared. I also learnt to see A16Z as a very powerful hype machine.

So it was a good place to revisit as I’m relaunching my Fintech series, and some questions came naturally:

Was it just hype?

Is there still a possibility that many companies will become FinTechs?

Should I even care?

I spoke to Lars Markull from Embedded Finance Review to find the answers.

TL;DR the answers are: No, but with a lot more nuance than in Angela Strange’s speech.; Yes; Yes

Lars has spent over 10 years in financial infrastructure. He's dedicated himself to embedded finance and supports brands, infrastructure providers, and banks when they look to build embedded finance products.

Abridged & Illustrated Transcript

George Aliferis: I think it's fair to say not every company has become a fintech. What's your view?

Lars Markull: The publishing date of that article was January 2020. I left open banking in 2019 and was looking for new areas to focus on. I remember well reading Angela's piece, and there's another from Matthew Harris from Bain Capital about embedded finance. It resonated with me because I've seen many companies trying to build financial products or integrate financial data. Often, the industry expert, the person who knows a specific industry, is best positioned to offer financial services. It's complex, but the products, like a bank account, a card, or insurance, are often commoditized. Non-financial companies can embed financial services effectively, what creates a value for the customer is putting them in context. This started almost five years ago with that article. Is this the future we're heading towards? The question is, will every company be a FinTech company? It depends on the definition. Is it revenue-based or a majority share of revenue needed to be a FinTech? I agree every company will be a FinTech eventually, but we haven't yet defined what that means or its timeline.

GA: If we put it on the hype cycle, where are we now? Are we near the plateau of productivity?

LM: The question makes sense but is hard to answer. As an embedded finance advisor, and with my brand 'Embedded Finance Review,' I use the term frequently, but embedded finance is broad. Embedded finance has been around for decades. Car financing at dealerships, for example, became a norm in the seventies or eighties. It's difficult to make a single statement about where we are. It depends on the type of financial product – payments, banking, lending, investment, or insurance – as some started earlier or are more mature in certain industries. Particularly in SaaS businesses, we might be at the plateau of productivity. Others are still developing.

GA: I love the answer. This is what this podcast is about: figuring out the nuances. I discussed with a previous guest, Matt Ford (NB: was a VC investor at Mouro Capital—now CEO of Sidekick), how concepts are important as a starting point, but not enough:

Analogies generally are a really powerful tool. So as VCs and as entrepreneurs, often the solution that you're either being pitched or pitching, It's incredibly complex and often, VCs have so many different businesses, having an analogy to anchor it to can be really helpful just to get you through that initial learning curve. And I suppose to draw that back into FinTech a bit more, the Angela Strange quote of everything is becoming FinTech and the AWS for FinTech is what she often talks about it as well, from an embedded finance perspective. Again, it's a really helpful analogy because most entrepreneurs and VCs know what AWS is.

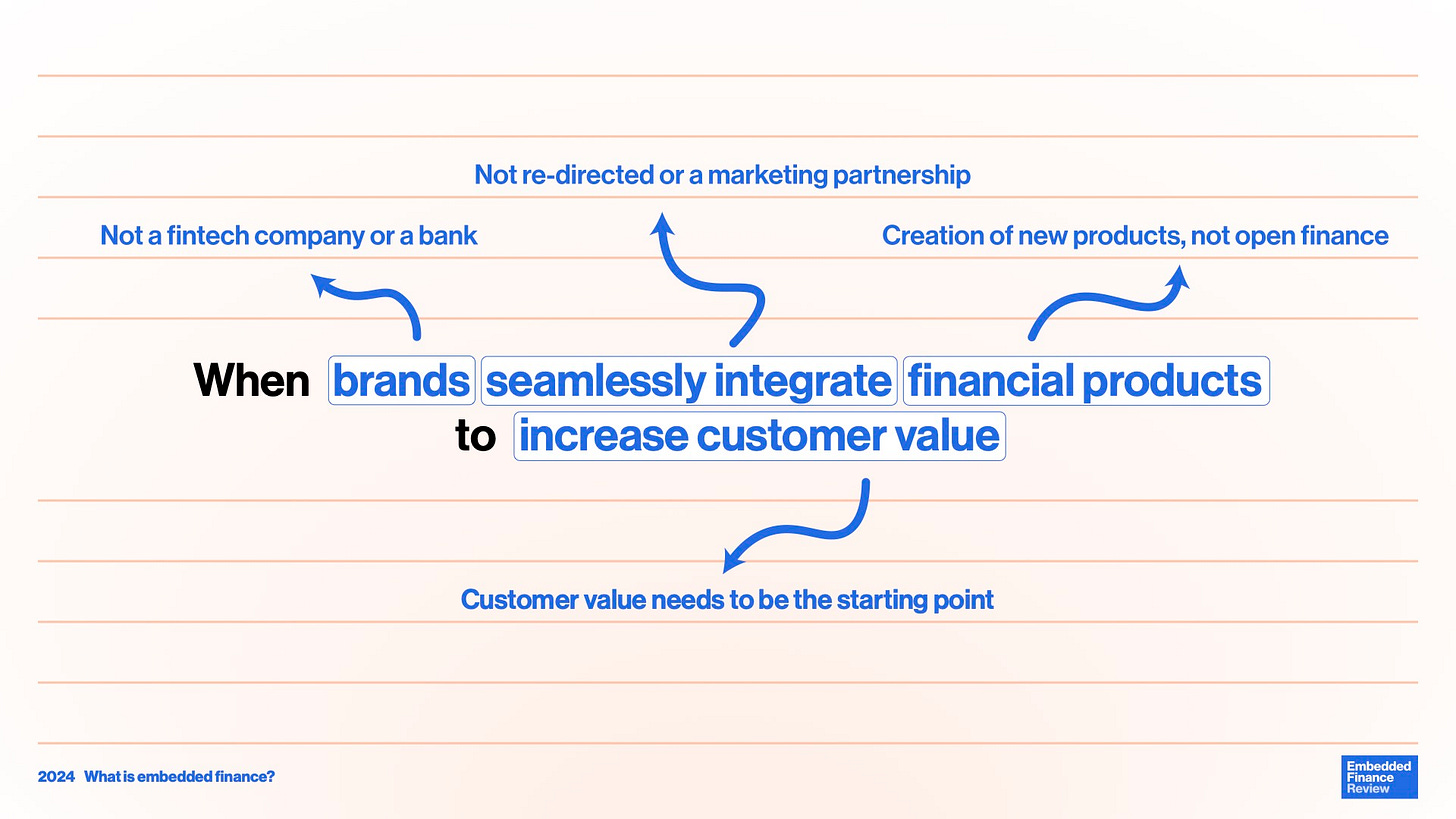

We talked about brands seamlessly integrating financial products to increase customer value, like Shopify. Can we go deeper into that?

LM: Embedded finance is widely used. Some companies call themselves embedded finance brands for perceived benefits. For me, a brand must be non-financial and seamlessly integrate financial products.

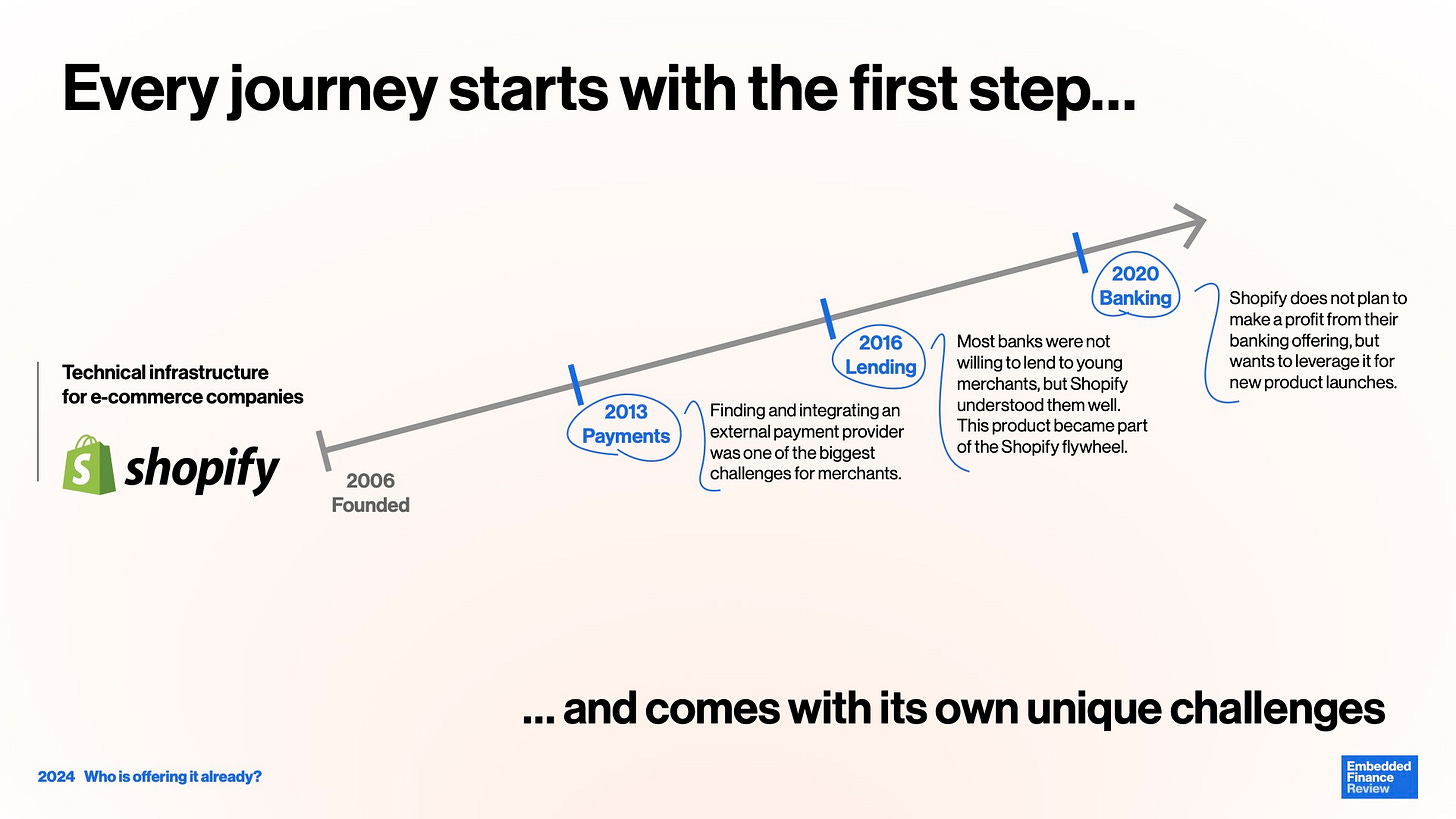

It should be a logical and new choice for financial products. Shopify is a role model in embedded finance, showing significant growth and API infrastructure for e-commerce. They've successfully launched products like payments, lending, working capital financing, and bank accounts over several years. This journey began around 2016, and although not instant, their journey exemplifies the importance of starting with customer needs and problems. It makes sense. Shopify was initially a place to sell online, now it's where you can integrate banking products. That convenience increases customer value.

GA: Thanks for clarifying; Shopify is indeed digital-native. If we take a brand like Starbucks, what does it do differently in embedded finance when its competitors just have loyalty schemes?

LM: Starbucks is a great example of embedded finance by creating additional features with their own cards, allowing prepayment for coffee, which encourages retention and reduces payment costs. Their system captures funds for Starbucks, enabling immediate use for investments, which banks can't do. This loyalty mechanism has led customers to hold substantial funds with Starbucks. It's indeed a journey, not just a plugin solution.

GA: How should brands approach this transformation?

LM: It depends on the industry and services sold. There's a difference between B2C, like Starbucks, and B2B, like Shopify. The focus should be on customer pain points and creating value. Initially, try to launch a product quickly and iteratively improve based on feedback. While selecting providers, think about those who can help achieve the initial stages quickly. Have a strategic view for progression, as providers might change as your business evolves. Initial products should yield customer feedback to convince the leadership of the relevance and value creation. In fintech and innovation, speed can have consequences.

GA: Let’s play “Fantasy Fintech”, without technical or regulatory constraints. What brands are well positioned? Could even my business, Orama become a Fintech? (Let’s say we produce podcasts for media brands that monetize through sponsorships. We could connect sponsors and podcasters, integrate payments, provide funding/lending opportunities…)

LM: We can think about what kind of brands we interact with. I guess there's a strong reason why Apple does a lot of these financial services in different markets, because a lot of people, including myself, use a lot of these products

B2B offers more opportunities due to inherent money flows. Thinking about your business, Orama could potentially handle payments and offer financial services within a hypothetical marketplace. This integration could begin by handling payments before considering further expansion into offering cards or banking solutions. Start with simplifying payments for smoother customer experiences, and later consider broader financial services. How about investment products or insurance considerations for unknown claims? Is there an opportunity for protection? Fixing payment processes paves the way for banking, which relates to receiving and sending payments. Investments and insurance can protect against unpredictable claims, yet they seem futuristic.

GA: It sparks many ideas. Payment, banking, investing, … talking about investing, previous guests included embedded investment specialists: DriveWealth (equity) and ZeroHash (crypto), but the applications I see are mainly brokerage for other financial companies. Is there still potential for embedded investing or is it marginal?

LM: Embedded finance includes payments, lending, banking, insurance, and investing. Investments outside banks face challenges, yet opportunities exist where current infrastructure is lacking. Employer-employee interactions, may offer potential for investment embedded in non-financial contexts. HR tools like Personio and Factorio in Europe are exploring this space, potentially serving employees with logging changes or planning savings during job transitions.

GA: The pension conversation ties in naturally with investment in non-financial context.

LM: Yes, especially since job changes are triggers for financial reflection. Instances like these, involving HR processes, provide an interesting intersection for embedded finance.

GA: Lars, thanks for your insights,

LM: Thank you for having me. Looking forward to seeing your embedded finance product at Orama.

GA: One day. But just like you, I won’t say when!

Bonus: We didn’t discuss this slide from Lars’s presentation, but it’s an important one because it illustrates the progress made over the last few years.

More about Lars Markull:

Follow Lars on Linkedin

Subscribe to Embedded Finance Review (newsletter, podcast, events)

The slides are from this presentation

Related:

Previous episode with DriveWealth (embedded stock brokerage)

Previous episode with ZeroHash (embedded crypto)

Recent publications

My latest on YouTube: 19,993 subscribers as I write this, could 7 people please subscribe?

Educational resources for investors

A curation of Alternative Investment startups

Alternative Investment courses

Tools (affiliate links)

Descript: for editing videos, podcasts, and using them as the foundations for articles

Wise: for paying in different currencies and earning on cash balances

Podcasting & Marketing

Orama (my business): helps brands grow with podcasts