Hi! It’s George from Investorama. I explore the world of Investing, Defi &Fintech on YouTube, Courses and Podcast conversations.

Thank you for joining me!

In this edition, we take a closer look at two Masters of sales & marketing. The front office team of Pierpoint, the fictional investment bank from Industry’s HBO. And the marketing minds of Masterworks, a real-life platform to invest in art.

The downturn in global markets will not stop the “Democratization of Alternatives”. It may even accelerate by it. Even if you are private investors you can expect to hear more from motivated sales people and creative data marketers in the near future!

Responding, or choosing to ignore, marketing and sales is a critical part of investing. It’s important to know what motivates the sell side and to understand what’s behind the marketing material.

What motivates sales at an investment bank?

Simple answer: sales credit.

I haven’t been hooked on the first series of Industry (I find the affairs and ‘action’ between characters, a bit too much). However, I find many of the scenes on the trading floor fantastic. They bring back memories of my time in the front office at places like Deutsche Bank. The products don’t always make sense, and the roles of each character are not lifelike, but where the series excels is in the tension between characters and the anxiety of executing trades.

There’s a scene where Eric, the head of sales, opens a meeting by declaring:

The traders will be here shortly with their axes. Double sales credits to anyone who fills them this month.

I wonder how much of that is intelligible to someone who has not worked in the industry, but this short sentence makes us stare at the heart of the trading floor.

I break it down on YT:

This scene is also a reminder of how obsolete some practices of “high-tech” trading floors are.

How many highly paid salespeople do you need to communicate a price to a client?

This is a type of role that is disappearing with technology or fintech. You can “stream” prices directly from a trading book to the buy side. You need commercial staff to initiate the relationship, and help to set up the systems but once that’s done it’s hard to see them in a very active role.

I plan to explore the impact of front-office tech in upcoming videos.

How much should a startup with ambitious growth goals spend on marketing?

For Masterworks, that figure seems to be $100mm annually based on a recent post from the CEO, Scott Lynn, who is looking for a new CMO.

To put that number in perspective, we can do a back of the envelop calculations based on the SEC filing of Masterworks. Each painting is securitized as shares and IPOed, so there are regulatory filings. They have offered around 50 paintings to the public in the last 12 months. Let’s say each painting is sold at around $3m, which gives revenues of $150m. A benchmark often used is around 10% of revenues. $100m seems out of proportion.

Maybe the $3m estimate was wrong, but even if the average price was $10m (it’s not) it would be an overized spend on marketing.

The answer to this could be trivial. The CEO may have just got the numbers wrong? On the job offer, the number is actually $25m.

This is intriguing, considering Masterworks’s love of numbers. I’ve covered their use of data to assess the “macro” performance of the art market. (TL;DR: I wouldn’t rely on their advertised performance). Now it’s time to look at the micro level: the data on individual paintings and how it feeds the marketing.

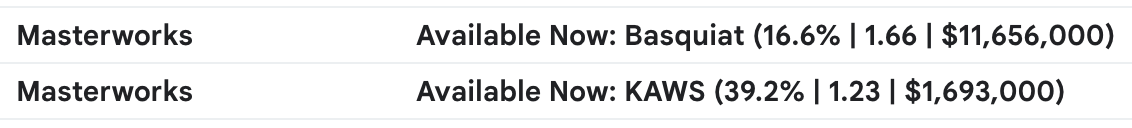

There were two offers from Masterworks in my mailbox, and this is how they appeared.

Given their focus on performance marketing, you can assume that the titles has been properly optimized. But what do the numbers correspond to?

The one on the left is easy. It’s the offer, or IPO price.

For the rest, you need to open the email. The first number corresponds to the Price Appreciation of Similar Works (let’s call it PASW).

The one in the middle is the Market Risk-Adjusted Appreciation (MRAA).

Before going into what they mean, you have to admire the power of frequency and consistency in Masterworks email campaigns. This data represent abstract concepts, that are not commonly used. Yet to the buyers of Masterwork, that receive emails weekly, they must become a reference. Whatever those numbers mean could be their whole decision framework.

You can imagine a reflection based on this week’s emails alone:

“Do I invest in a Basquiat with only 16.6% PASW but high MRAA or a Kaw with 39.2% PASW and an MRAA of only 1.32?”

Now let’s interpret the actual number.

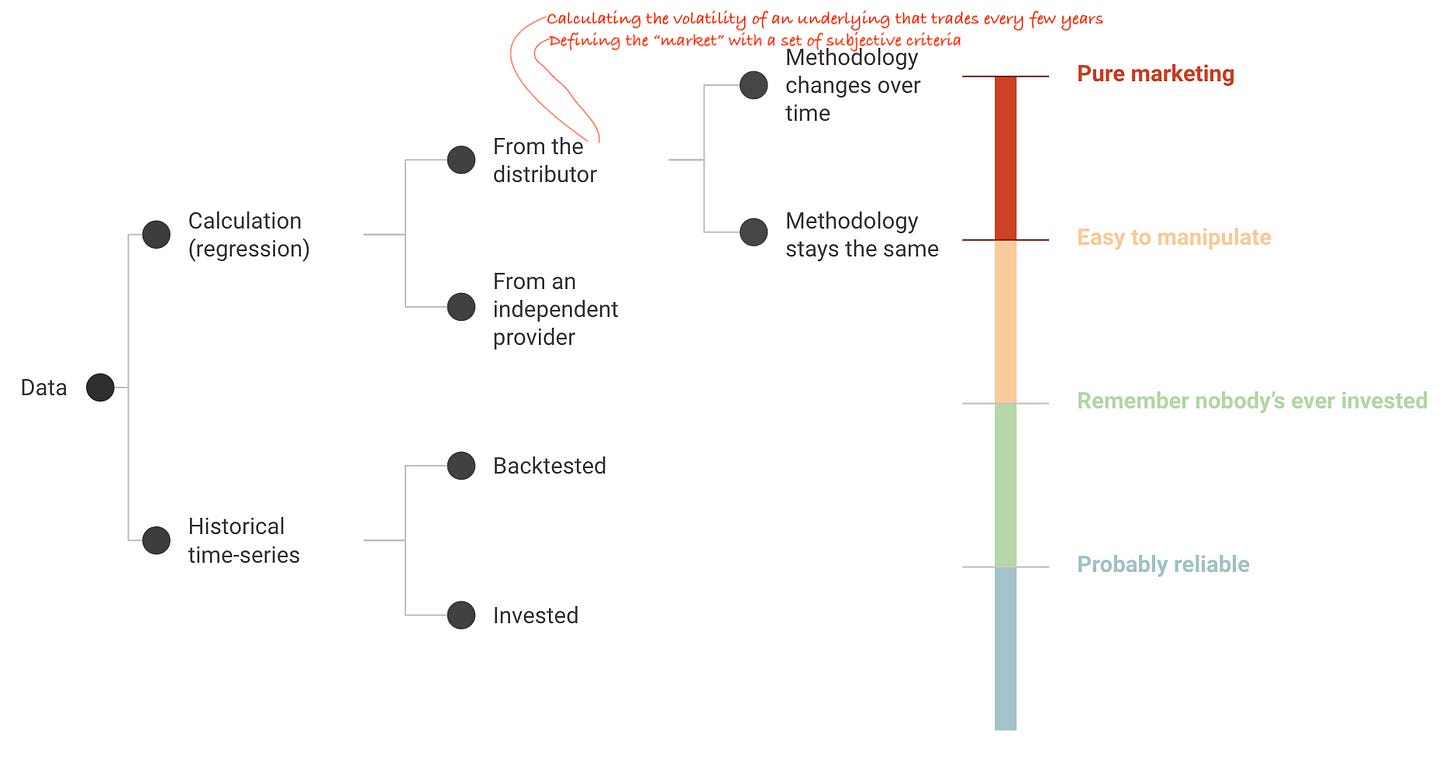

PASW: is based on repeat-sales from the artist at auction, but not every work.

The set of similar sales comprise selected paintings by Jean-Michel Basquiat with the following criteria: canvas paintings executed from 1982 to 1984, that measure 60 inches by 95 inches in height to 45 inches by 70 inches in width, and that to the best of our ability to determine, feature discernible words and/or phrases. […]

It’s a narrow set of criteria chosen by Masterworks.

Basquiat is hot, in May one of its painting sold for $110m, the priciest work ever sold by a U.S. artist. But not all its works are on the rise (see below)

By quantifying the unquantifiable, Masterworks can create a benchmark that maximizes its PASW.

MRAA: is traditionally called the Sharpe Ratio

Reflects the average annualized artist market appreciation or depreciation of repeat sales at public auction for a specific artist (paintings only) minus the risk-free rate, divided by the volatility (as measured by standard deviation) of those returns in that artist's market.

Except here the volatility is measured on sales that occur only every few years or decades, whereas the S&P 500 that it’s compared to, trades daily.

I find it hard to characterize these two computations in plain English, so I’ll reuse my framework for assessing data from illiquid assets. It needs to be updated in light of the above evidence.

Marketing and sales are necessary for any industry. But for newly accessible there is a greater risk of misselling because there are checks and balances mechanisms in place. Investors (private mainly) appear more vulnerable but at the same time, they have infinite resources available to arm themselves with knowledge and insights. Understanding the motivation and mechanics of a sales pitch is part of that.