🎧Private Equity: Debunking the Myths - with Trym Riksen, Head of Portfolio Management at Gabler

An eye-opening discussion that separates fact from fiction in the world of Private Equity. (The podcast is back)

Hi! It’s George from Investorama - Separating investment facts from financial fiction. This is the first of a series on the Private Equity industry.

You can watch it on YouTube👇🏼 or listen on all the podcast platforms.

Separating investment facts from financial fiction is my new tagline. And there’s no industry more reliant on myths than Private Equity. We debunk major ones (returns, volatility, diversification) with Trym Riksen, from Gabler an independent advisory boutique for large institutions, and family offices.

Private Equity’s Founding Myth

We started the conversation with what I called the “Founding Myth”, which can be found in a very serious Harvard research.

Below is the 2002 update in which you can see the “Returns and Site of Private Equity Investments of the Yale Endowment, 1978-2002”.

And at the bottom “Since Inception 31.4” (in percentage).

This research has been quoted infinite times and has whet pension funds’ appetite for Private Equity for decades, but it’s grossly misunderstood. And to be fair, the way the data is presented is very misleading.

The Private Equity grows through 1) returns and 2) increasing allocation from the Endowment, which in turn grows through donations.

Assuming that Yale made 0 additional allocations to Private Equity. It’s tempting to calculate the value of the initial investment after 25 years as 3.2*(1+31.4%)^25

Initial Investment = 3.2

31.4% for 25 years = 922.3

Final Result = 2951.4

But that doesn’t match, or come close to the actual result of 1,492. And Yale invested a lot in Private Equity since 1978 so our calculations are way off!

The explanation is trivial: These are not returns. They are an IRR, and yes that means Internal Rate of Return, but it’s different from the Geometrical Returns which we normally consider!

Here’s a spreadsheet where you can see the calculations.

Keeping the myths alive today

Here’s a 2023 marketing brochure from Blackstone, the Private Equity giant.

We discussed it at length with Trym. If you want to know the details, it starts at 6:23.

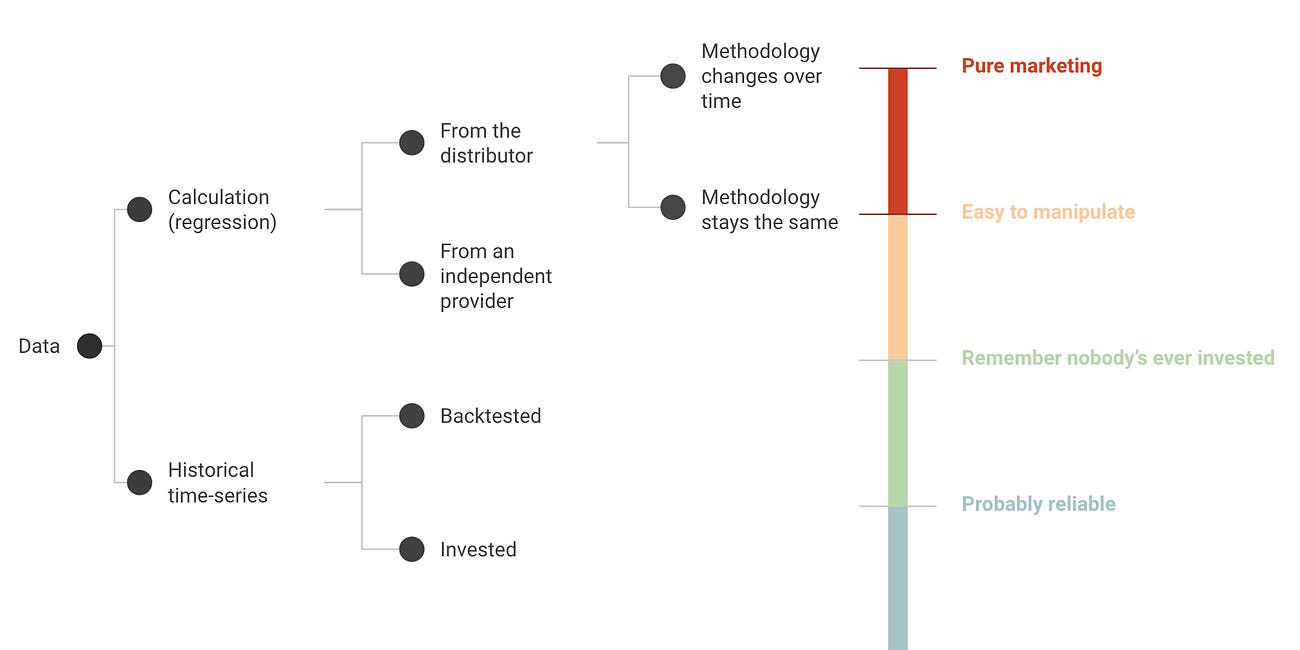

To make it very short: the volatility and returns displayed for Private Equity and other private assets are absurd. They can’t be compared to listed securities. But they are numbers that are quoted by the industry and the media.

Three quotes

You can’t trust the data presented by PE firms:

If you put data from private equity series into a spreadsheet where you have listed assets, you'll just get noise and nonsense. It's a bullshit approach. You are led into believing that you have huge diversification benefits, but all the diversification benefits comes from the appraisal values being different from market prices.

Even the most sophisticated err over the long term:

If you go to CEM benchmarking and look at the annual reports on pension funds you would see, for example, that hedge funds have had very, very poor performance in the past 20, 25 years. Still the allocation to hedge funds private equity has increased. So this example alone could kill the hypothesis that people invest into asset classes that have been successful.

And here’s a hard-hitting take on “Democratization”:

Every time one of the biggest players in in the financial industry talks about the democratization of finance. You should be worried.

Thanks a lot to Trym Riksen for his time and insights!

I recommend following him on Linkedin. His posts are thought-provoking, well researched and extremely interesting for their content and the conversation they generate.

Related articles:

Why Are All Illiquid Alts Outperforming? Masterworks & friends

I’ve been visiting properties. We’ve outgrown our flat (2 young boys!). When we move, it will be my most significant investment ever. Technically, it will be an alternative and illiquid asset, although I don’t see it this way. When considering a new investment, we’ve all seen that “

🎧The Real Deal about Real Estate and REITs - with Phil Bak

Hi! It’s George from Investorama, your guide to the future of investing - without the hype. Below I’m sharing a few highlights from my latest podcast conversation: a fascinating deep dive into real estate with Phil Bak, the CEO of Armada ETFs, the company behind

great take ... IRR is a % and also CAGR is a % but definitely not equal ... must lesson for many out there, thank you!