The legend of Defi and its mythical Stablecoin creatures

Busting Crypto myths to find the Yield Graal

Hi! It’s George from Investorama.

Thank you for joining me in the exploration of the future of investing -without the hype.

In March, I wrote: Can Stablecoins Yield a New Hope?

This is not the Hero part of my portfolio. It’s not something that I intend to hold forever. Aside from the yield, I am interested in the liquidity and low cost of trading compared to bonds. Before allocating meaningful sums, I’ve tested how fast I could unwind (assuming the centralized exchanges are not down).

Stablecoins on Cefi are the Antiheroes of my portfolio, but you don’t always choose who you team up with.

Here are just a few Stablecoin-related news that happened since:

UST has crashed (I wrote about it here)

The Celsius platform, a stablecoin lender has stopped withdrawals. Others (Blockfi) may also run into trouble

Three Arrows Capital, a large crypto hedge fund is running into trouble and may collapse

Solend: the “Autonomous Lending & Borrowing Platform” on the Solana chain, or Defi, has decided to change its governance rule and grant itself the power to liquidate positions.

Not good. On the positive side, these events have clarified the true nature and the strategies of what is sometimes called Defi, Cefi, or Cedefi.

Yet on the surface, Stablecoins investments look like a great addition to my portfolio, with 10% APR, low transaction costs and I’ve converted GBP into USD (+6.5%), but not if they collapse!

These insights are weapons that can bust the myths and industry jargon. Then it will be time to reassess Stablecoins.

There is no Decentralization in Defi

Solend was, until 19 June, one of the champions of true Decentralization. It’s a platform for borrowing or lending where the rates are set autonomously. If markets move sharply, a process for liquidation is in place. It is based on the initial protocol governance and implemented via smart contract.

Sounds quite decentralized, but the Solend team started getting nervous about a ‘whale’, AKA wallet 3oSE9CtGMQeAdtkm2U3ENhEpkFMfvrckJMA8QwVsuRbE. It had supplied a position of close to $200 million in SOL, and borrowed around $108 million of USDC and USDT.

There are a lot of questions about the existence of this wallet that I won’t cover, but here’s a thread from the founder of Solend that explains the situation, which I will summarize:

If SOL drops below $22, the wallet will need to be liquidated

The current liquidity of decentralized exchange cannot absorb a transaction of this size. Therefore, it could dramatically impact the price of SOL.

The slippage would put Solend at risk (and a few other players)

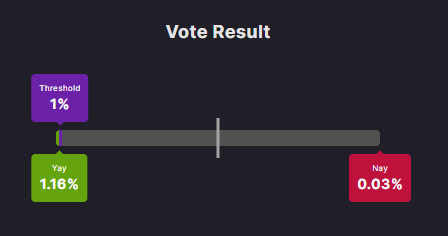

Given this uncomfortable position, the Solend team created a governance proposal that would allow them to liquidate the positions. The proposal was voted yes by 95% of the votes. But it was passed on a Sunday night with just over 1% of voters:

This event marks a milestone for Decentralization because it shows it can be reversed at will. Dapps (Decentralized Apps) are a form of enterprise led by people. They use smart contracts. That’s efficient and automated but it does not mean that governance is decentralized.

MakerDAO the organization behind the stablecoin DAI, still looks very ‘decentralized’, but it is an outlier.

But when we hear Defi, in 99% of the cases,I it relates to a Blockchain-Based Financial Application (Can we call them BAFA?)

Cefi (or CeDefi) is not Defi

Solend shows the transparency of BAFA/Defi. You can see the exact position and trade history of the Solend Whale.

It is not the case for lenders like Blockfi, Celsius, Crypto.com, Vauld, and more.

Most media articles that cover the trouble at Celsius, refer to it as a DeFi lending platform. Cefi or CeDeFi is a better term, although it’s still inaccurate.

CeDeFi is short for Centralized Decentralized Finance, and if you think it’s confusing, you are not the only one. What it means is that these are companies that offer access to yields from Blockchain activities with an interface that’s easily accessible through the traditional financial rail.

If you place your USDT on Blockfi, you will see a yield figure (currently 7%) and nothing else. As an individual, you can only borrow. It’s similar to a short-term bank deposit. You can’t lend or know what the ‘bank’ will do with your money.

On Solend, you can lend, borrow and see what everyone else is doing.

There’s no magic for yields

The Cefi platforms and their hedge funds counterparts are opaque by nature, but the information gates open when they are close to liquidation. The information gathered recently on Blockfi, Celcius and Three Arrow Capital sheds light on the source of the extraordinary yields offered to the public.

Before diving in:

The yields are falling while nominal interest rates are rising (on Blockfi, for example, stablecoin APR is around 7% vs 10% last year)

We’re not taking into account any Rewards yield. They are not negligible, nor are they sustainable - a topic we will cover later.

Now let’s dive in:

Yields are/were subsidized. We saw it before with the likes of Uber and Wework. If you have “unlimited” VC money and you want to grow fast, selling your product at 90c when they cost $1 is a solution. It’s unstainable (and not very clever) and it seems to be what Blockfi has been doing.

Lenders are exposed to tokens. Even though they may only deal with stablecoins, the counterpart of the Cefi lenders will have a long exposure to BTC, ETH and the rest. When those crash, the liquidations will impact the lenders’ balance sheet.

Hedge fund strategies are crowded. We know that Three Arrows Capital, had significant positions in stETH, of Lido staked Ether, which moves in line with ETH and should converse once the Merge is finalized. It is a widespread yield strategy. Convert ETH into stETH (current yield: 4%) → Lend stETH→ Borrow ETH → Repeat for maximum leverage. The problem is that everybody trades in the same way, and once the unwinding starts, stETH and ETH will diverge enough to… liquidate your leveraged position.

What does this banner from Three Arrows Capital signify for their risk management practices?

There is no Stablecoin market!

On Coingecko, there are 86 stablecoins totalling $156 billion in assets.

If we look at the S&P 500 as a benchmark for the investable universe, the 500th smallest capitalization is IPG Photonics at $4.8 billion. With this filter, four stablecoins remain. Everything else is below $1.5 billion.

To understand the “market”, look at the fallen UST. Now rebranded TerraClassicUSD, it is still among the top stablecoins by market cap. As of 15 June, it’s the 24th largest “stable”, trading at 0.007. It remained in the top 10 until the end of May (it started collapsing on 9 May).

Magic Internet Money, which looks like it has the exact mechanism as UST, except they don’t hide that it’s magic, was #5 until recently. It’s dropped to 12 following outflows but remains pegged.

In other words:

There are only four tokens that have achieved significant traction. And that’s probably enough for traditional investors.

Tether (USDT)

USD Coin (USDC)

Binance Coin (BUSD)

Dai (DAI)

There is no safety in numbers, though. The market capitalization selection does not mean that these coins are safe.

Two fundamental characteristics dictate the use of stablecoins.

There is no upside (100% potential downside)

They have the same value (unlike bonds where prices fluctuate)

They have similar utility (you can do the same thing with USDC and USDT)

It’s a case of DYOR - Do Your Own Research, but I will share the conclusion of my research: only own USDC and DAI, avoid USDT (in fact, I’m a little bit short), and ignore BUSD. I’m thinking of sharing my notes in a future newsletter.

What that means for Stablecoins and ‘Defi’ investing

Defi or Blockchain-Based Financial Applications (BAFA) is more transparent, solid and safe than Cefi.

You can replicate the yield strategies used by the Cefi platforms or their hedge fund counterparts. It may take some time, effort and transaction costs. It may not be a good idea. But unlike the traditional system, you can access the strategies and tools.

It’s time for pragmatism. Decentralization can be a cumbersome ideology

After Stablecoins: A New Hope, it’s time for another episode in the saga.