Real Estate can't be the keystone of your portfolio

But they can still be normal stones. An outsider's guide to REITs (3/3)

Hi! It’s George from Investorama.

This is the third instalment on REITs - an instrument to access an asset class that’s classified as “alternative” but touches all of us: Real Estate.

A keystone (or capstone) is a wedge-shaped stone at the apex of a masonry arch or typically round-shaped one at the apex of a vault. In both cases, it is the final piece placed during construction and locks all the stones into position, allowing the arch or vault to bear weight. (Wikipedia)

In the previous phases of our exploration of the (concrete) jungle of REITs through the eyes of a private investor or an industry outsider, we’ve discovered:

The true nature of REITs (The REIT reality)

How they can be used (REITs as building blocks and hedging tools)

Here we’re wrapping up our REIT exploration. In an ideal world, we’d be finalizing the keystone, giving it a perfect shape to fit in our perfect construction. In practice, we’re more likely to see if the stones we have can be used and where.

We will be using one of Finominal’s quant tools (I’ve already mentioned their article on REITs), the “Diversification Booster”. It will give us an overview of the diversification benefits of various REIT funds compared to other asset classes.

We’ll be looking at the following US REITs funds and stocks across sectors:

VNQ: Vanguard Real Estate (RE) ETF (Broad index)

HAUS: Armada Residential

SRVR: Pacer Data & Infrastructure

REM: iShares Mortgage Real Estate

And some of the largest US REIT stocks

Diversification Benefits of VNQ

Let’s start with the undisputed champion of REIT funds, the $59bn Vanguard fund.

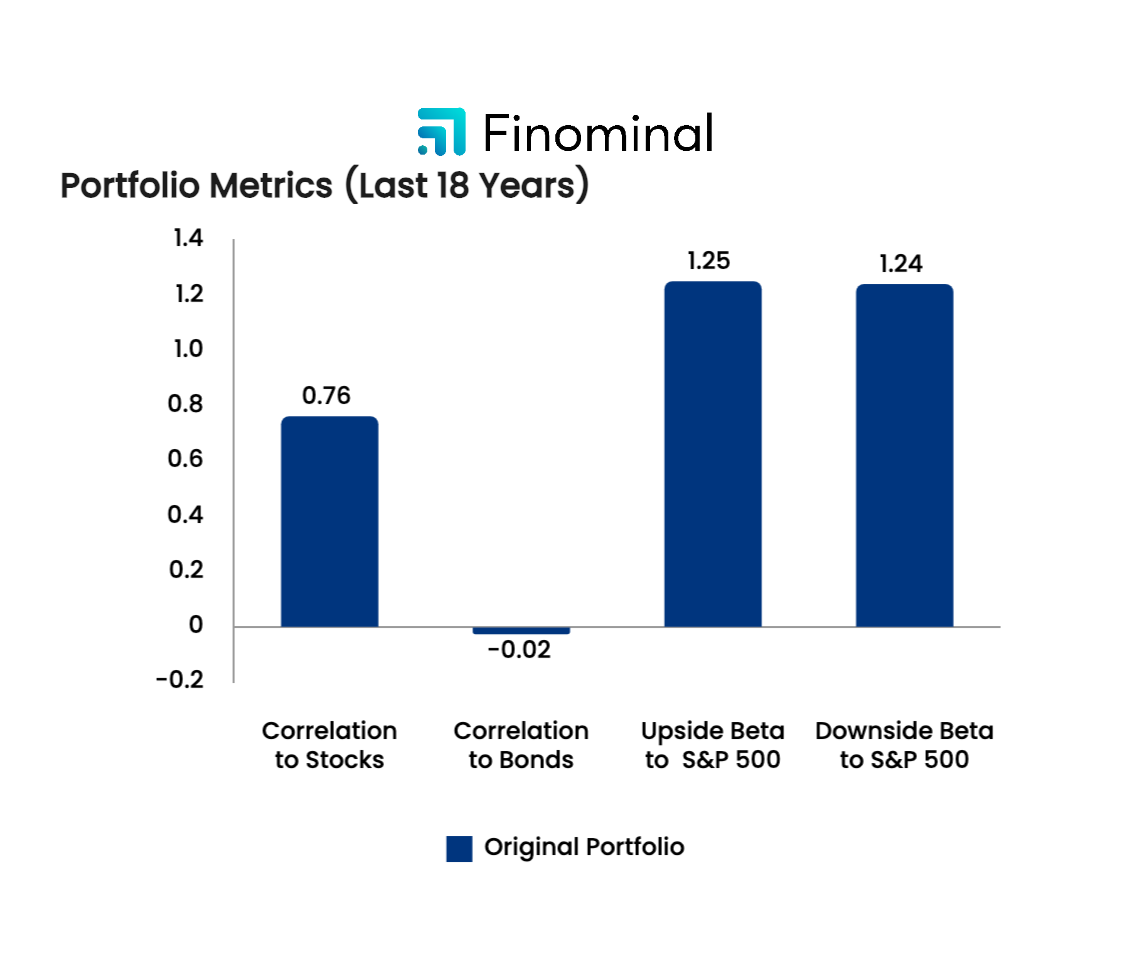

Starting from the right: The high beta (1.25) indicates the fund will go up or down in line with equities but with ampler movements, which is counterintuitive if you think of Real Estate as a relatively safer option.

We expected a high correlation with stocks (0.76; 1 would be perfectly correlated), based on its exposure to commercial and industrial activities and our previous examination.

The 0 correlation with bonds is more perplexing.

Because of their income characteristics, REITs are often considered an alternative to bonds.

In our conversation, Phil Bak described them as instruments that are part debt and part equity.

This is also a way to understand a real estate company: Since little cash flow is retained to fund new property acquisitions, REITs must issue equity and debt to grow. Buying real estate is not cheap, so REITs are generally highly leveraged.

That should make them correlated to high-yield bonds. Instead, we observe a negative correlation.

Can a more selective approach make a difference?

US Sectorial REIT ETFs

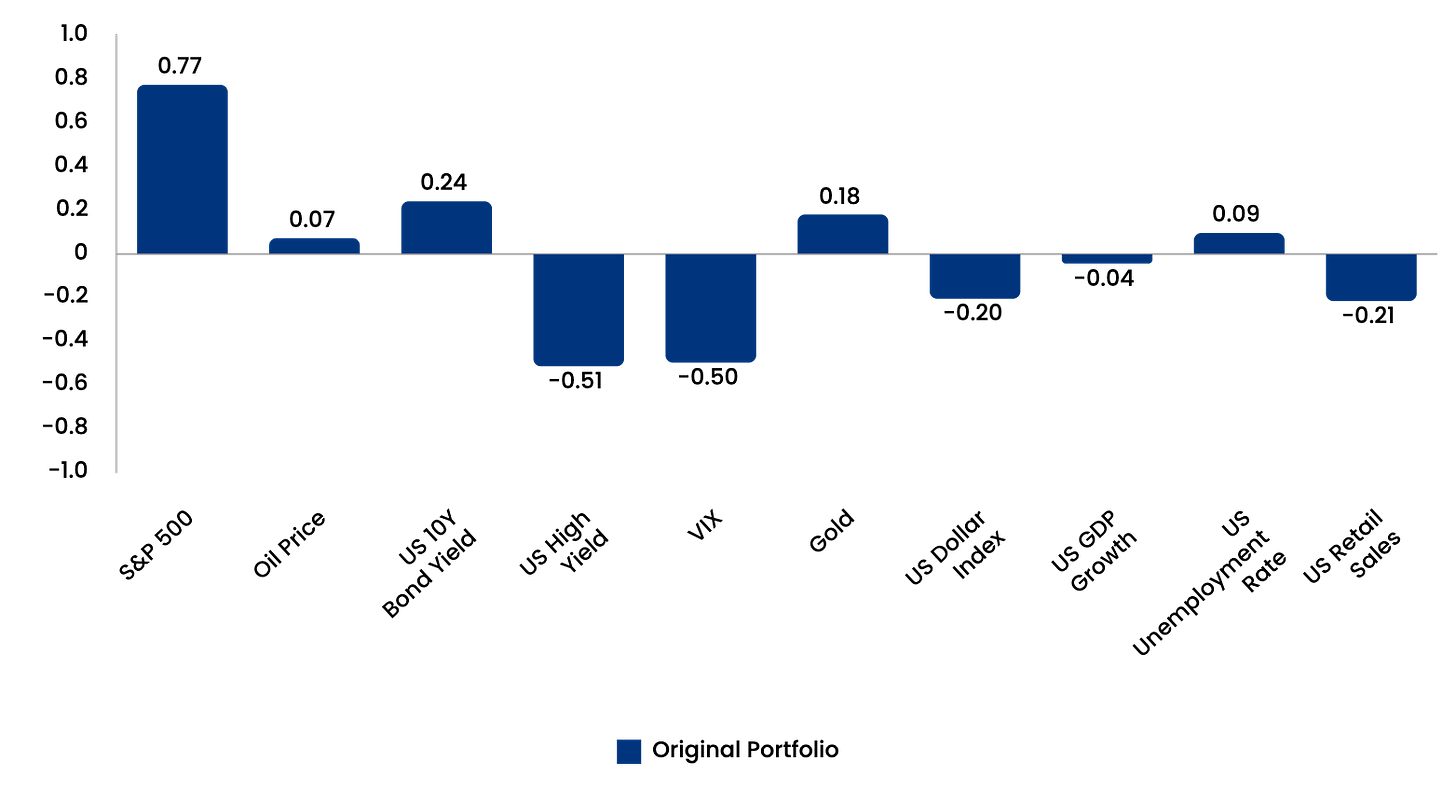

SRVR (tech): Very similar results to VNQ

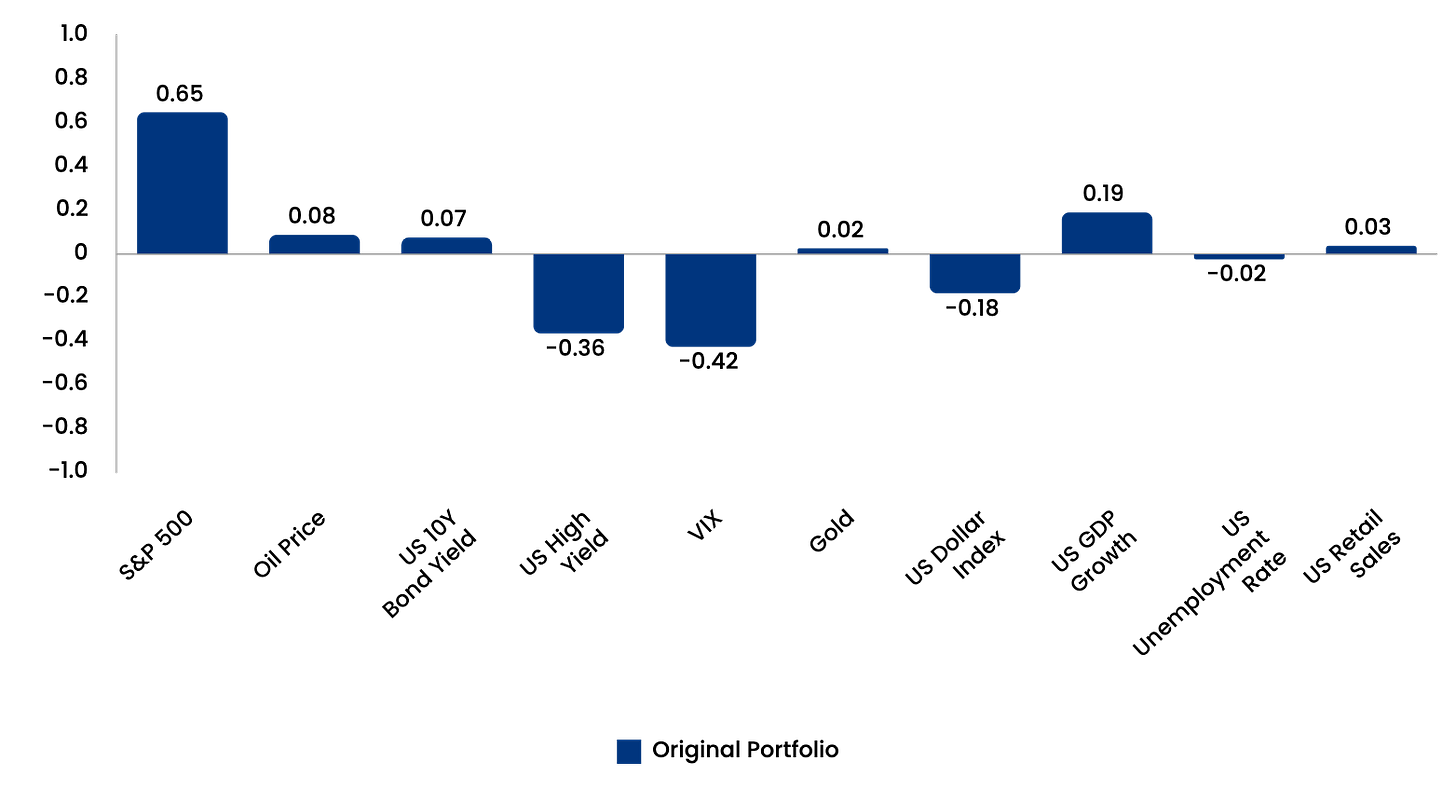

HAUS (residential): Less correlation to equities, more correlation to Government bonds (also a lesser beta to equities 0.75 vs 1.25 for VNQ)

REM (mortage): Even a mortgage REIT exhibits equity-like property, like its peers, although they are milder.

The results are very similar with the largest REIT stocks. (I won’t post them here as it gets repetitive).

It appears that the equity nature of REITs “overcomes” their Real Estate assets. This makes them negatively correlated with high-yield bonds (like an equity index)

Mortgage and Residential REITs offer better diversification and a more conservative risk profile

REITs and Bonds

The low to negative correlation with bonds stands out. It contravenes a widespread idea of REITs as a bond alternative.

As we come out of decades of near-zero interest rates on government bonds, the typical private investor that favours bonds would have a significant proportion of high yield. For such a portfolio, REITs can be a good fit. They are diversifying while contributing to income generation.

A closer examination shows the negative correlation is not stable:

Here is an explanation of this complex relationship (S&P, 2017):

Ultimately, whether interest rates are rising or falling does not seem to be the key driver of REIT performance over medium- and long-term periods.

Rather, the more important dynamics to address are the underlying factors that drive rates higher.

If interest rates are rising due to strength in the underlying economy and inflationary activity, stronger REIT fundamentals may very well outweigh any negative impact caused by rising rates.1

Although the explanation makes sense, it’s very nuanced. We currently observe the opposite: rising rates that seem to affect negatively real estate prices - although this could be only a short-term move.

REITs and home prices

We’ve hinted at REITs as instruments to step on and off the property ladder. But if REITs, even residential ones, are mostly equity, how does that work?

[In the UK] at the national level, the relationship between house prices and the stock market is characterised by left tail dependence, i.e., they are more likely to crash, rather than boom, together.2

If we look at the recent developments in the UK market, house prices have flatlined and seen a slight decrease from their peak. At the same time, Residential REITS have fallen by nearly 40% - although RESI is a “high yield” equivalent.

From a long-term perspective, I also found this chart about the Stocks to Real Estate Ratio in the US.

There’s a striking coincidence between the top of 1929 and the bottom of 2009. It indicates relative long-term stability. But it’s disappeared since then. The stocks are ‘winning’ (mean reversion coming?). We can’t ignore the unusual near-zero interest rate environment in that same period. Perhaps it benefits stocks even more than property.

In practical terms:

Residential REITs seem to be less risky than equity markets (low beta)

The common sense approach that stocks (including those of Residential REITs) are more volatile than house prices seems to be validated

If you are an asset owner that looks to sell those assets to buy property, Residential REITs are far from a perfect hedge, but they are probably the best available (or least worse depending on your perspective) tools you have.

Can we draw a conclusion?

The idea that REITs borrow some risk characteristics from stocks and bonds while behaving like a different asset class has to be abandoned. That implies that REIT can’t be the keystone of one’s portfolio. But can they still find some utility in portfolio construction?

Although their relationship with bonds is complex, they are a good fit for an income-focused portfolio. Primarily because they behave like equity (diversification) with a guaranteed distribution (income).

Residential, Mortgage REITs (and maybe specialized stocks and ETFs) are likely better additions to diversified portfolios than broader ones. They can also play a role in stepping on (or off) the property ladder - although this has to be approached very carefully.

The selection criteria depend on your current portfolio of liquid assets, but also your illiquid ones: you need to consider investment properties and residential status.

Yes, it’s a bit muddled, but if your retirement, your first home, or pension depends on it, you can’t rely on the pitch you’ll see repeated endlessly in various forms (Yield; Returns; Diversification).

https://www.spglobal.com/spdji/en/documents/research/the-impact-of-rising-interest-rates-on-reits.pdf

https://link.springer.com/article/10.1007/s11146-021-09854-0

Great coverage, very insightful! REITs as a good fit indeed for an income-focused portfolio ... Residential, Mortgage types with diversification benefits also ... that's my approach as well! Thank you!