Tech, Trust & Tangible Assets—A New Efficient Frontier for pension investments

When allocation meets engagement - a UK pension perspective

This already looks my most profitable post ever.

Over dinner I told my wife: “Can you believe that there are over 3 million lost pension accounts in the UK? And by the way, do you know where all your pensions are?” (She’s not very interested in finance, but I had been talking with a lot of pension experts.)

It was a blur for her at first, but yes, it turns out she did. That’s when it dawned on me that I had no recollection about the pension status from the first job I took in the City of London. I was one of the 3 million!

The total loss amounts to an estimated £31 billion. That’s “only” 1% of the total £3 trillion, but is the symptom of a more critical issue: a lack of engagement, resulting in insufficient contributions, and leading to a looming pension crisis.

In my 20s, although I was working in finance, I had no interest in that pension thing; I contributed to my pensions unknowingly and maybe unwillingly.

I have no recollection of it until I was in my 30s, earning more, starting to think about tax, and realising the generosity of the pension incentives. I also had no excuses my clients where pension funds!

Now in my 40s, I am fully “engaged” as I’m writing an article about pensions, and I hope to recover the lost pension (more on that later).

But it’s easy to imagine an alternative history. Where I work in a different industry and my lack of engagement and contributions continues past the 20s.

Today there’s an opportunity to solve this through technology, trust and tangible assets.

This article is based on podcast interviews with:

Eve Read (Senior Director of Strategic Delivery): Smart Pension

James Lawrence (Director of Investment Proposition): Smart Pension

Hugh Cutler: Mobius Life

Alyshia Harrington-Clark: PLSA (Pension and Lifetime Savings Association)

The article is my personal interpretation and does not necessarily represent their views or that of their employers.

Tech-powered engagement against undersaving

In the UK, the legislative minimums for saving are not sufficient to sustain most people in retirement. Individuals now need to make active decisions about how much they choose to save for this reason. Eve Read reminds us: "It’s already too late. There is going to be a generation of people who will be retiring on DC pensions that are not large enough."

The looming pension crisis will affect over 2.6 million people1 and will be most acute around 2040, as it will see the highest number of 'financially struggling' or 'undersavers' reaching retirement.

Eve notes, "Some of the biggest issues that we see in DC are about people just bluntly not saving enough…”

Undersaving is the most important factor, and it stems from a lack of pension engagement. You can’t expect people to be actively contributing without being engaged.

The UK government has commissioned extensive research on pension engagement2, and defines it as:

‘interest and involvement in the non-workplace pension, where involvement is a positive decision to do, or not do, something in relation to their pension.’

Achieving high levels of active engagement is a significant challenge; despite nearly two decades of effort in the UK, pension engagement levels are “probably less than 50%”, according to Eve.

And it’s not for lack of trying.

Campaigning helps but it’s not enough

The UK is well-known for its advertising and has come up with various campaigns, involving gentle monsters:

And local “celebrities”:

They have moved the needle, but a lot more needs to be done.

For Alyshia Harrington-Clark of the PLSA “technology plays a key role in facilitating engagement”.

She mentions UK-wide initiatives such as the pension dashboards programme, allowing individuals to see all their pensions in one place. We also discussed how a modern interface could be “more visual with tools like illustrations, diagrams, and interactive features to help people understand complex information and make better choices”.

Neobanks then Neopensions

UK-born neobanks such as Monzo, Starling and Revolut, are the stars of the UK fintech scene. They started by creating user experiences before obtaining their banking licenses.

New digital interfaces can improve the user experiences in pensions too.

But just like with neo-banks, the real opportunity lies in a modern core. All 3 neobanks have built core technologies from scratch, whereas most of the banking system still rely heavily on legacy systems.

Similarly, legacy systems were built decades ago and were adapted from DB systems rather than built for DC.

Any infrastructure needs to deliver first on the core purpose of administering pensions for millions of individuals through thousands of workplace pensions. In the case of Smart, this administration system is Keystone3, a proprietary system that required over a million hours of R&D and is cloud-native. It enables more nimble investment decisions and the creation of apps and web-based tools offering a smooth online experience.

Apps that engage, but softly

This is where the pension industry can learn from Silicon Valley, but it’s not about creating a Robinhood-level of gamification-induced engagement. Pensions require a nuanced approach.

Here are some sound bites from my conversations:

There is a balance between frightening people just enough to prompt good action and frightening them into inaction [Alyshia Harrington-Clark]

Mask some of the complexities of pensions, while still providing necessary information [Hugh Cutler]

There is a balance to be struck with engagement. You don't want to create an army of people logging in daily or weekly to check their balance, as concerns about volatility could lead them to take detrimental action. The goal is enough engagement. [Alyshia Harrington-Clark]

Offer "micro interventions" when a member chooses to log onto their app (even if infrequently) to provide small amounts of education, ask key questions to understand them better, and serve up more relevant information [Eve Read]

Focus on tangible incomes: Shift the perspective from abstract assets in a "pension pot" to income in retirement [Hugh Cutler]

Making pensions easily accessible and visible, on a phone in one’s pocket, can help people’s awareness.

With the right UX and content, it can boost their understanding and facilitate simple activities.

But even the most optimised app needs substance to have a real impact, and this is where the allocation can feed back into the engagement.

Tech-enabled “optimal” allocation

During our conversation, Hugh Cutler mentioned wind farms as a specific example of assets that pensions can potentially access, unaware that I was looking at the Rampion Wind Farm off the coast of Brighton as I was recording - it’s not just about the view, it also powers my home!

Linking allocation and engagement

This prompted two questions:

From an investment perspective, what impact does an allocation in this type of illiquid assets have on the portfolio?

From an engagement perspective, if the asset is tangible, can one get a better sense of ownership that will result in higher engagement and contributions?

The separate answers could be:

Let’s look at all the assets in light of Markowitz’s Model Portfolio Theory - what are the asset characteristics of wind farms and their impact on the efficient frontier.

Yes, in particular for those that were not engaged by other elements.

But on second thought, there’s a better question that combines the two to find better outcomes for investors.

Since allocation in tangible assets affects engagement:

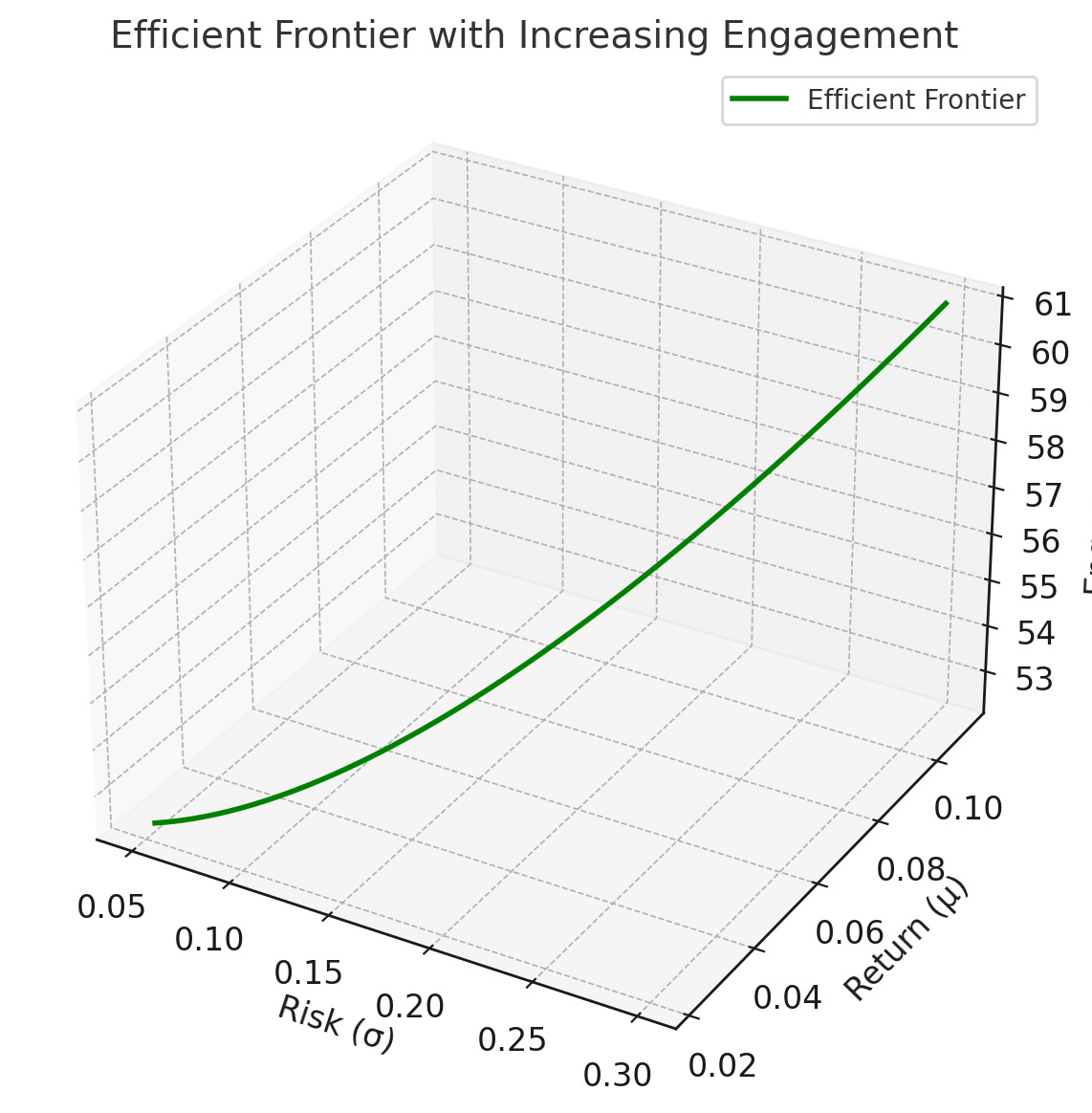

What is the optimal asset allocation that combine performance and contribution?

We’re not attempting to provide an answer to this question, but taking into account the engagement has to play a role in portfolio construction.

I tried to visualize this on ChatGPT, but didn’t succeed and ran out of credit. The green line is wrong but at least it goes up with engagement (vertical axis)

Broadening pension’s allocation horizon

I put the allocation question to Smart Pension’s Director of Investments, James Lawrence. His answer was opportunistic there is a "huge gap here for building good renewable infrastructure, particularly in the uk" (like the above mentioned wind farm)

His fund is available to seize it because

It’s a pension fund with the long-term liability horizon that matches the assets’ characteristics

Unlike most other DC pensions, their tech stack enables them to do so

While Keystone powers Smart’s core, the tech approach extends to other partnerships for investment solutions. Mobius Life acts as an investment platform for the "plumbing". They provide the connectivity and infrastructure needed to “open new doors”, including to “alternative” assets.

There are no rules restricting the amount of private assets a UK pension fund can hold, according to the Pensions and Lifetime Savings Association (PLSA). The restriction so far has been technological, not regulatory.

Smart Pension is one of the many UK pension funds increasing its allocation to private markets in its default fund, aiming for 15% in private markets.

NB: The recording with James was prior to the Mansion House Accord, which was signed by major DC plans, including Smart4.

Seventeen of the largest workplace pension providers in the UK have expressed their intent to invest at least 10% of their defined contribution (DC) default funds in private markets by 2030, with 5% of the total allocated to the UK.

From private to tangible assets

James gives more examples, like members potentially seeing EV charging points or swimming pools heated by data center excess heat that are funded by their pension scheme. He states this is a "complete different paradigm shift versus where we've been in pensions." He suggests that when members see their pension contributing to tangible projects and potentially providing a financial benefit, they become "a lot more on board".

“It's a way of drawing people into the pension, both in terms of making that provider attractive because they've got interesting assets […]. It attracts people in and also once they're actually invested, if they can vote on the companies in their portfolio or if they can see the assets and feel the assets they are then engaged”, said Hugh.

The examples above all relate to “sustainable investing,” something that Smart is an advocate of, and that can also help with engagement. But that’s not new, and it’s not hard to imagine a broader perspective. You could have tangible assets that are not “green”, starting from infrastructure and real estate.

Looping allocation and contribution

Talking to James, it is clear that these types of allocation are not driven by the engagement potential of the asset but by a rational decision process within the limits set by the board of Trustees.

They also represent only a small percentage of the total assets.

Investment innovations are not just engaging, UK-based tangible assets. James Lawrence also mentioned new instruments for DC pensions such as a “zero-cost equity” structure, providing an efficient exposure to equity through derivatives.

It can’t all be wind farms visible from your window!

For the scheme, it’s about identifying their potential to influence the critical contribution question - through increased engagement.

This can be done through increased transparency or a more proactive approach involving active communication. Something that’s made easier with digital tools.

From the UK to the world

The UK pension landscape is at a pivotal moment, where digital innovation, pension technology, government support, and the democratisation of alternative investments meet.

The shift to a defined contribution (DC) mindset remains incomplete, with a fully realised model still years away. But the UK could be on the cusp of a breakthrough. While it is too late for some savers, there is an opportunity to design a better system holistically for future generations —one that encompasses the whole value chain from investment proposition to individual experience, to deliver better outcomes. And it involves adding a new dimension to the traditional risk/return model: engagement, where private assets will play a part. Not because they are private, but because they can be more tangible.

While pensions operate in a highly regulated country-specific environment. Many global DC pensions will face similar challenge due to their delayed beneifts and retail nature, so the changes in the UK - if successful - could become a reference for others.

Epilogue

If I look back to at my own experience. If instead of joining a “default fund” when I signed up the job contract and then forget about, I had been:

Notified once in a while - according to my preferences

In these notifications, there was something that I could relate to (e.g. the swimming pool where I go weekly belongs to [sport_infrastructure_fund] and is heated by the data centres from [direct_investment] by the pension provider chosen by your employer).

I would likely feel better about my employer, be more engaged about my pension, contribute more, and be unlikely to forget about it.

I didn’t.

Luckily, I kept my old Yahoo email (unlimited data storage). That’s how I found out I had a pension there that I had forgotten about and needed to claim back. There’s a website that helps retrieve lost pensions5. I’ve written to the pension provider - a letter sent by post. The digital revolution hasn’t reached that corner of the pension sustem yet. I haven’t reclaimed it yet, but if it's invested in anything reasonable, I should at least have a few hundreds of pounds there making this post will rank much higher in terms of profitability than anything I’ve ever written. It’s a mini pension experience in itself - with an uncertain outcome but one that can only be beneficial.

https://www.ftadviser.com/retirement-income/2024/10/04/uk-to-hit-pension-crisis-point-in-next-2-decades/

https://www.gov.uk/government/publications/lessons-on-pensions-engagement/lessons-on-pensions-engagement#definition-of-engagement

https://www.smart.co/what-we-do/keystone

https://www.plsa.co.uk/Policy-and-Research/Document-library/Mansion-House-Accord

https://www.gov.uk/find-pension-contact-details