The Crypto joke & the Defi bore

You don't need to believe the crypto hype to envisage the transformational effect of the Blockchain

Hi! It’s George from Investorama.

Thank you for joining me in the exploration of the future of investing -without the hype.

I caught up with a long time friend and ex-colleague at a Jubilee thing in a park with family and stuff. After a stellar investment banking career, he is launching a fund venture based on value investing. I casually dropped the idea that I thought Defi was a good place to find uncorrelated returns. Maybe the context was not right. Anyway, he laughed and genuinely thought it was a joke. I wanted to explain that I was serious and had written a newsletter about it. But then a ball landed close to my feet, and I had to join the game and leave the conversation.

For all the talk about ‘the exodus from Wall Street to crypto’, many folks in traditional finance, including my friend, think it’s a joke. In many ways, it is.

It’s essential to understand first why whatever’s happening on the Blockchain can be ridiculed is necessary.

You don’t need to be excited about the whole thing (Web3, the Metaverse, NFTs…). But there are two aspects of crypto that even the most traditionalist financiers need to pay attention to: the improvement of the financial infrastructure and the access to financial tools.

‘Crypto’ is tiny, messy, overhyped and not going anywhere

I find that there’s little middle ground when discussing the Blockchain. At both ends of the spectrum, sceptics will dismiss the whole thing, while crypto enthusiasts will dismiss those that "don’t get it".

Here’s an attempt at listing

Tiny

First, the whole crypto industry has a market capitalization of around $1.2 trillion. That’s about the same as Silver (10 times less than Gold). So if you look at it as an ‘asset class’, it’s a marginal one at best.

Messy

Then, of course, there are many Ponzi schemes that are bound to collapse but may flourish first, as Terra did. And even “good” projects can be scammed out of millions (here are 20 examples).

Overhyped

There is excessive hype around concepts like Web3, which resembles the dot com era of the late 90s or the Metaverse. The latter seems to have faded. But Web3 is alive, and A16Z raised a $4.5 billion fund to grow it.

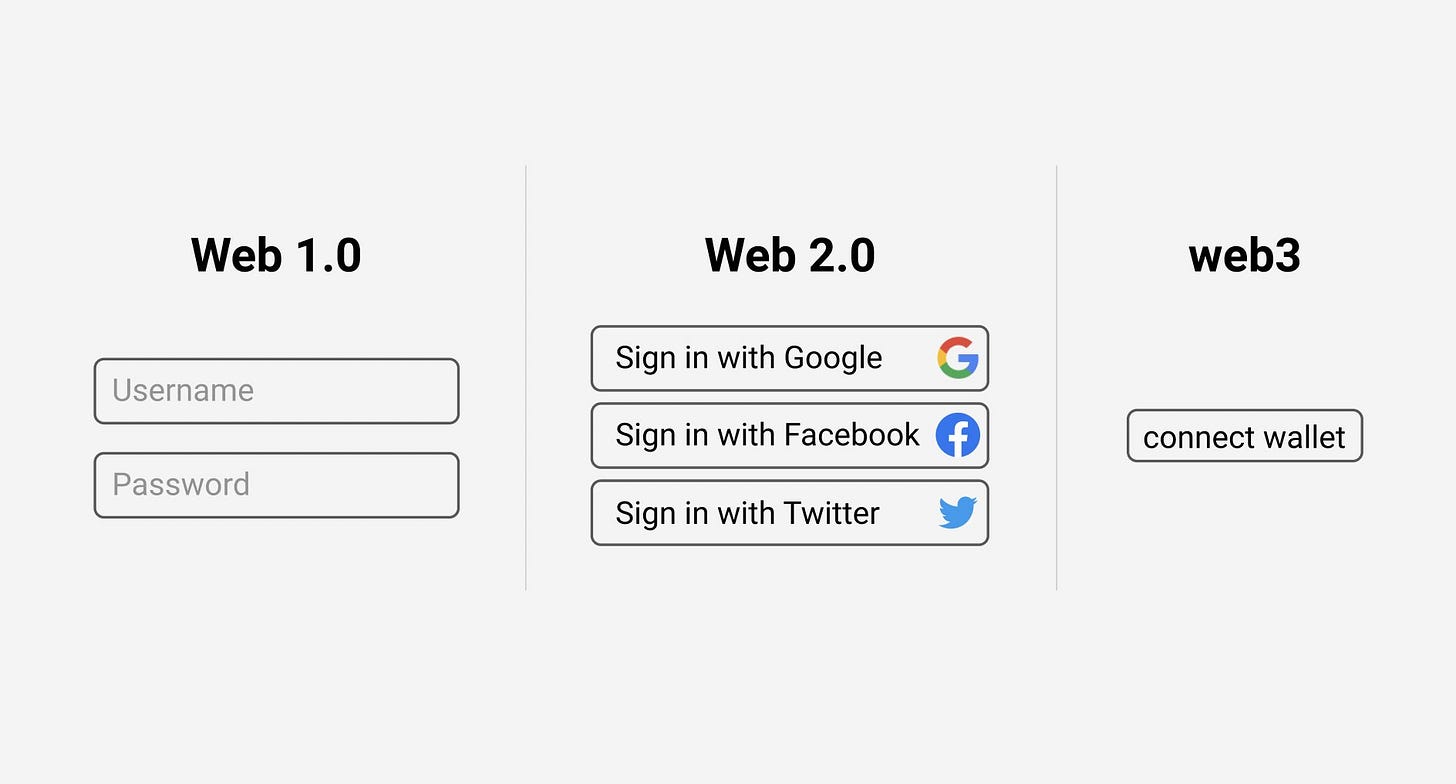

I think the only place where I’ve experienced it first-hand is on Polymarket, which allows betting on real-life events with your Ethereum wallet. The login and payment mechanism would be separated if it was a regular (Web2.0) site. On Polymarket, they’re linked. It’s a better experience. Web3 is a powerful concept, but it’s also plastered on too many projects where it’s not essential. And even if it was, it’s mainly about a better UX and less login. I don’t think it matters as much as the Defi aspects we will cover below.

Not going to the moon

Despite the price correction, there’s a persistent belief in the industry that crypto can still go 100x or to the moon. Hirander Misra from GMEX1 was more specific:

The world economic forum spoke about 10% of global GDP being stored on blockchain by 2027. We worked out that if that was true that would be $24 trillion worth of assets stored on again, even if we become, come remotely even half way towards that, that's a huge amount of of money that's in a digital cryptographic form.

So maybe it’s 20x from here and not 100x, and that would be pretty impressive anyway. Yet it doesn’t mean that any existing tokens will see their valuation grow. There could be many more tokens. Here’s a personal comparison:

When I launched my video business in 2012, I thought video would 100x, which it more or less did. But videomakers didn’t become much richer. There are just a lot more of them.

Token price appreciation is even more uncertain than equity markets because of the dilution embedded in the reward mechanisms that are common in the industry.

What has the Blockchain ever done with us?

Even when we’re trying to look at current, real applications, it’s a disappointment. This article from Balaji, a VC and former CTO of Coinbase What has the Blockchain ever done for us? draws a parallel with a hilarious Monty Python scene.

It’s great, but I found the conclusion disappointing:

We've already seen 10X improvements in gold, international wire transfers, and crowdfunding.

If we leave aside wire transfers for a moment. I don’t care about 10x Gold and Crowdfunding because I have no use for them.

Tiny, messy, not going to the moon and not doing much. So why bother? Why was my friend wrong? Below are a few things I wish I could have said in the park that day.

Meaningful, not fanciful, impacts of the Blockchain

To be fair to Balaji, his list is from 2018. I’m sure he would expand it dramatically today. And wire transfer is actually a huge deal.

Financial infrastructure

Global remittance fees stand at an average of 6.30% in Q2 2021. I discussed with the CEO of Veeem2 how they use the Bitcoin network to reduce the cost of sending money abroad from multiple % to just a few bps, particularly between the USD and MXN, the largest remittance market.

This is not radically new.

Fintech, with the example of Wise, has already improved the process. Still, crypto can simplify it and reduce costs even further by making sending money as easy as sending an email. This is what Veem does.

That’s for wire transfers. Now let’s consider another part of the financial infrastructure: investment. The chart below depicts the lifecycle of an investment.

It’s a process that works, but … it’s complicated and inefficient. How much could simplify the circle above?

From my conversation with Lex Sokolin3 of Consensys:

Our industry structure has no inherent meaning. There is nothing special or meaningful about custodians, investment managers, financial advisors. […]

It's really important to understand how the system works in order to participate within it or build around it or build a new one.

I spent many years in that, but I think what's really liberating about web three is getting connected to the idea that new systems can be built.

Crypto rails can modernize the existing legacy financial infrastructure and make it more efficient. This is not a spectacular change, but bringing down the costs of running the financial system by just a few bps would transfer trillions of dollars away from financial intermediaries and into the real economy.

Access

And finally, there’s the ability to access financial tools that were only for institutions—something we discussed with Carlos Mercado, the founder of CharlieDAO4.

What I'm excited about is for people to have access to things that don't have access to. So for example, I really like whay Aave (Note: Aave is a decentralized protocol that allows people to lend and borrow crypto) is doing, being able to deposit ETH and borrow USBC. Most people have probably never gone to a pawn shop before. They've never put a watch down and borrowed money and went back and paid for their watch. That ability to take out loans against your own assets is very powerful because it's not a taxable event. It gives you access to liquidity. You still own your asset.

Pawn shops have generally a bad reputation because of their high interest rates, but imagine a very efficient pawn shop where you lend and borrow. You can lend your watch (you are not wearing it and someone wants to impress at a meeting) and earn from it.

Or you can borrow against it. I don’t know. Maybe you’re going to the beach. You don’t want to bring your Rolex, so you leave it at the pawnshop and borrow a stand-up paddle against it.

This real-life comparison also brings us back to the utility of assets discussed earlier and to the ability for all to access financial tools that used to be the prerogative of institutions. It empowers the individual or smaller organizations. For investors, it provides tools to hedge or position themselves in a bear market.

That’s it: it’s about access and financial infrastructure. And they’re linked. The financial infrastructure aspect connects it to the economy and the real world, it underpins the tools that we can access. Together they form what is called Defi, or decentralized finance. In reality, it’s rarely decentralized, but it’s a shortcut to talk about finance on the Blockchain.

This is not the area of crypto that gets the most attention, and it’s down 60%. But it’s the area of crypto that will shape the future of investing.

Still reading? Here are some personal programing notes.

I’ve barely posted on YouTube or here lately. It’s a strange case of Creator Block due to having too much to talk about. My brain jumps from topic to topic without completing anything.

I’m going to try to solve this by going back to the basics, planning ahead, and integrating various mediums. What that means for you reader, subscriber:

The basics are two key themes: 1)the future of investing and 2) without the hype. I am going to be more selective and just focus on exploring the future and exposing the hype.

Planning means I’ve got topics ready, and I will attempt a weekly posting schedule (at least from now until mid-July)

Integrating means I will bring together the YouTube content, podcast and newsletter.

Thanks for your attention; it’s precious!