Liquidity (part 2): Are you KIIDing me?

I've read the smallprint about liquidity, but it was too late

Hi! It’s George from Investorama. Happy year of the Rabbit! People born in the year of the Rabbit are believed to be vigilant, witty, quick-minded, and ingenious. These are excellent skills for investors to have in 2023!

In my previous write-up about the many states of liquidity, I assigned a bit of homework (to myself): to read the small print of ‘PINT’, the open-ended infrastructure unit trust, to find out what the liquidity limitations could be.

As a reminder:

PINT invests in illiquid infrastructure assets, but its shares trade on the LSE. It currently trades at a 5% discount to NAV, but that varies daily. If there is selling pressure, then the price of the shares will decrease, and the discount to NAV will increase, which will deter sellers. The shares trade on the LSE, but brokers will ultimately need to create or redeem shares through PINT. So they manage the liquidity.

The result:

There is no mention of liquidity on the broker’s site. Likewise, there is no mention on the KIID (a two-page 'fact-sheet' style document which includes the critical information about a fund).

It is, however, mentioned on 15 pages of the prospectus as a risk factor

there may be limited liquidity in the underlying investments of the Group and potentially limited liquidity in the Shares

But this still doesn’t tell us explicitly what can happen in the (unlikely event) that an investor wants to redeem an amount more significant than the cash at hand. PINT can’t simply sell bits of its investments in the “National Broadband Ireland” project to meet redemptions.

The answer I was looking for appears on page 132:

[….]the Directors of the Company’s powers to repurchase Shares is entirely discretionary.

Shareholders of the Company are not entitled to redeem their investment in the Company.

So what?

I’m not surprised to find the clause. There had t be something to protect the Company.

But I’m surprised by the wording.

Shareholders are “not entitled” to liquidity, and it’s “entirely discretionary”. These may be standard terms, but I was expecting additional “colour”. Maybe the Company had to use a reason, such as “market turmoil”, or there could be a limit to the size of the orders or a mechanism that delays redemption if needed.

I don’t know. I was expecting something else.

The only thing that can prevent the Company from halting redemption is reputational and commercial risk. But in theory, at least, you could be stuck in the fund… forever?

From PINT to HOME & theory to practice

I don’t intend to share my shares, but I was pondering the theoretical prospect of the unit trust stopping redemptions and how it could make an amusing pun with its share code: PINT.

Then I realized that I had a practical example in front of me: HOME1 (Home REIT Plc), a unit trust that aims:

To deliver inflation-protected income and capital growth over the medium term for Shareholders through funding the acquisition and creation of high-quality homeless accommodation across the UK let on long-term index-linked leases.

This is an instrument whose structure is very similar to that of PINT.

If you try to trade it, you will get the following message:

The last price appears at 38, a 67% to NAV, but that doesn’t matter. It’s not something you can trade on. There is news about HOME. It started with a damning report from Viceroy Research, a short seller that includes allegations of misleading shareholders. If it were a regular company, you would still be able to sell the shares at a reduced price.

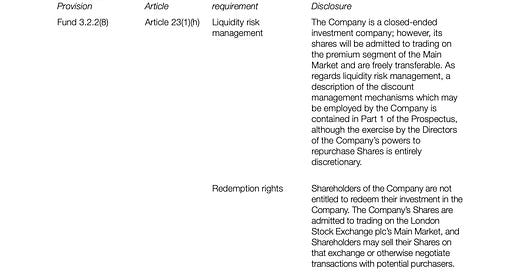

The KIID of HOME doesn’t mention liquidity once, but again you can find the details in the Prospectus (P19/170).

While the Directors retain the right to effect repurchases of Ordinary Shares, they are under no obligation to use such powers or to do so at any time and Shareholders should not place any reliance on the willingness of the Directors so to act

Τhe wording is different than PINT, but the meaning is similar: the repurchase of the shares is discretionary.

What does it mean for DIY investors in Alts?

My bit of homework showed that:

Liquidity is not an entitlement. It’s at the discretion of the Issuer

The information above will not be evident to most investors

The case of HOME shows that it’s not a theoretical question. And it is probably an example of the more frequent case:

problems at the company→ bad press → falling price → redemption.

BREIT, the hugely successful open-ended fund real estate fund hit its redemptions limits recently in part because its performance looks so good (we discussed it before). It’s open-ended but not listed and trades at NAV, so the mechanism differs from the UK’s unit trusts.

But it’s not that hard to imagine other situations. If a prominent investor needs to redeem, they would probably negotiate directly with the Issuer. But that also carries a risk for small investors.

Liquidity is an area where investors’ mindset does not match their portfolio.

Assume that many investors will be surprised when an Issuer announces that it no longer wants to redeem the shares as it is entitled to.

And where regulation lags behind the practice.

The KIID is seen as a cornerstone regulation for investors. Usually, it allows skipping the prospectus (197 pages in the case of PINT) and is more readable than the simplified prospectus, which is a copy-paste of the former. It’s also explicit about what needs to be featured.

Liquidity is not part of it because it’s not deemed critical information.

If the “democratization of Alts” is marching faster than regulation, investors needs to adjust their perspective.

I think one day I will need to explain why I invested in a company providing HOMELESS ACCOMMODATION(!), but that’s not today’s point.